2024 Schedule K-1 Form – Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust, including income as well as credits, deductions and profits. A K-1 tax form inheritance statement must be . Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a .

2024 Schedule K-1 Form

Source : schedule-k-1.pdffiller.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coIRS 1065 Schedule K 1 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.comSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coK1 form: Fill out & sign online | DocHub

Source : www.dochub.comSchedule K 1 Tax Form for Partnerships: What to Know to File

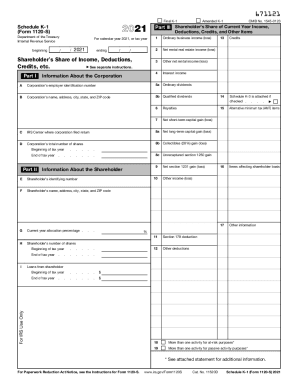

Source : www.bench.coIRS 1120S Schedule K 1 2021 2024 Fill and Sign Printable

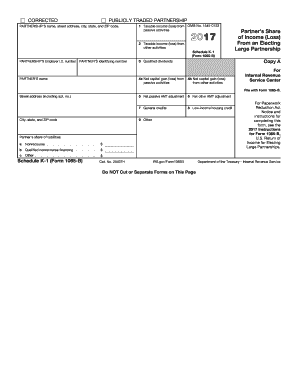

Source : www.uslegalforms.comSchedule K 1 1065 2017 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.com2024 Schedule K-1 Form 2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable : This form is then used to prepare each Schedule K-1 for the partnership’s owners to claim their share of the partnership’s income and loss on their individual tax returns. Form 1065 is the . The types of forms to filled for an S Corporation and an LLC are a 1120 S along with Schedule K-1. The form that will be filed for a C Corporation, is 1120. The form that will be filed for a sole .

]]>